If you’re off to setting up an e-commerce business or any website that facilitates payment transactions via the internet, then you need to read this piece.

One of the biggest challenges that people face in this situation is choosing a payment gateway.

Without a payment gateway on your website, your customers will have to either deposit money to your bank, issue a cheque, or jump to another third party site to complete the transaction.

Plus it’s also a lot safer to conduct an online monetary transaction using your credit/debit card details through a payment gateway.

There’s no way you can expect the higher number of sales without a payment gateway.

What is a Payment Gateway?

I’m sure you’ve seen an EFTPOS while shopping at stores, the black box-like device that the cashier uses to swipe your card? A payment gateway is the online equivalent of that.

A payment gateway is an application service provider that process credit card information and authorizes card payments for online retailers.

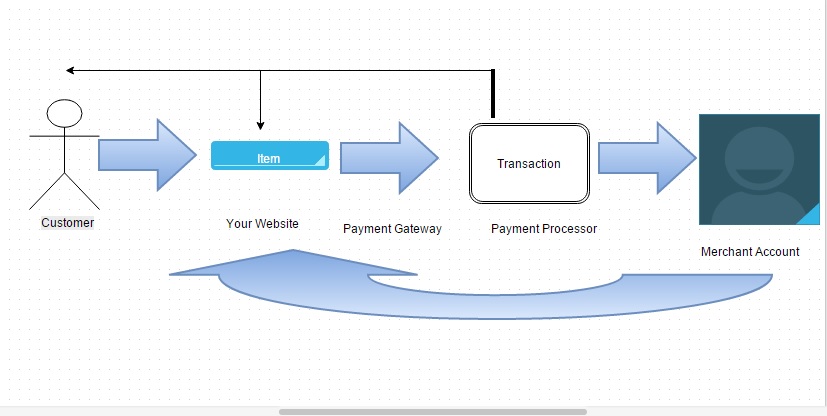

Suppose you retail books online. When a customer who has a Visa card purchases a book from your website, they enter their credit card details to make the purchase.

These details are sent securely and in an encrypted format from your website to your chosen payment gateway.

Then your account that is also referred to as the merchant’s bank account and that will have a payment processor already set up to receive this information will then communicate with the card company. In our example, the company is Visa.

Then a series of checking would be done, like Visa would determine which bank had issued them that card, and if the customer has enough credit (or account balance in case of a debit card) to make this purchase.

The bank then sends an approval back to the card company (Visa) who sends an approval to the merchant’s bank, who in turn sends an approval to the payment gateway and which approves the transaction to the website.

The entire process would hardly take half a minute, but there’s a lot going on behind the scene.

Also, note that when you choose to install a payment gateway is because you need to earn the customer’s trust. Because conducting payments over a payment gateway offloads your customer’s card details without storing it.

And that means your customers’ personal financial details aren’t hacked into.

Best Payment Gateways in India

CCAvenue

One of the oldest names in the world of payment gateways, you might have come across this if you did online shopping before it became mainstream.

Not only do they offer a horde of payment options like debit cards, net banking, credit cards, ATM cards, Bank IMPS, Bank EMIs and prepaid instruments, they also keep introducing new changes regularly.

With payment through multiple currency options and zero setup fee, this is a popular option. They, however, do charge AMC from a year after the date of setup.

PayUbiz

With customers like Snapdeal, Bookmyshow, and Goibibo.com, PayUbiz is a trusted name in itself.

With customers like Snapdeal, Bookmyshow, and Goibibo.com, PayUbiz is a trusted name in itself.

They have a variety of payment options and claim to boost your sales by 12% through dynamic switching, mobile optimized page, and other features.

They claim to have the lowest debit card pricing as they charge 0.75% commission for transactions lower than Rs 2000 and 1% for transactions exceeding Rs 2000. They also have Economy, Silver, Gold and Platinum packages to choose from.

Citrus Pay

Another known name in the circuit, probably their USP lies in the fact that they can capture an impressively high number of transactions. And thus improve the overall conversion rate.

Another known name in the circuit, probably their USP lies in the fact that they can capture an impressively high number of transactions. And thus improve the overall conversion rate.

They have a flat transaction rate, which is 1.99% + Rs 3, and their seamless multi-device compatibility makes it easy to pay on any device.

Although there is no setup fee involved they charge an AMC of Rs 4900 every year.

EBS

Owned by Ingenico group and offices based in most metropolitan cities of India including Kolkata and Delhi, EBS is a slightly pricier option as they come with a setup cost of Rs 11,999.

Plus you would also be expected to cough up Rs 2400 as Annual Maintenance Fee.

If you, however, aren’t deterred by the cost associated with this payment gateway, they do have a number of plans that you can choose from.

Their commissions rates are also pretty much in tune with other payment gateways in India. For instance, they charge somewhere between 1.25% and 1.50% for debit card transactions.

Payzippy

This is a Flipkart group brainchild and besides being their payment gateway, Payzippy does have other popular websites like Lenskart and Zansaar as their clients.

They don’t charge any setup fee OR annual maintenance fee. Payzippy offers PSI DCC certified services. With claims of simple and transparent pricing options, they charge 0.75% for less than Rs 2000 worth transaction and 1% for transactions exceeding Rs 2000.

With an Indian e-commerce giant like Flipkart backing this payment gateway, this is worth the consideration. However, at the time of writing, Payzippy isn’t accepting new customer or merchant accounts. But you can keep a tab on them to check the current status.

Zaakpay

This payment gateway is on the list mainly because of its customized service.

Touted best for startups and small businesses who aren’t looking to shell out a lot of money for a payment gateway, not only Zaakpay comes with no setup cost but they also provide you with pricing quotations based on the type of business you have.

Zaakpay charges an AMC of Rs 2400 from second year onwards.

Instamojo

A lot of websites that deal mainly in selling services opt for this payment gateway.

A lot of websites that deal mainly in selling services opt for this payment gateway.

Instamojo will help you collect payment through links. You can send a link to your customer, and they’ll enter their card details and make the payment without even going to your website.

They charge no setup fee or AMC and have a flat rate of 1.9%

Here is a comparison chart with all the basic details of the seven payment gateway options.

Although this is a pretty comprehensive take on the availability of payment gateway options in India, if you are looking to get one installed make sure you choose one that complements your requirements best. And be sure to read their reviews online, after all it is a matter of both convenience and security and also indirectly your brand’s goodwill.

Although this is a pretty comprehensive take on the availability of payment gateway options in India, if you are looking to get one installed make sure you choose one that complements your requirements best. And be sure to read their reviews online, after all it is a matter of both convenience and security and also indirectly your brand’s goodwill.